Estate legacy planning involves strategic distribution and management of assets post-death, ensuring wishes are honored while minimizing tax implications and legal challenges. This process includes creating a comprehensive will, implementing trusts for asset protection, and regular updates to reflect life changes. Professional guidance facilitates tax-efficient planning, avoids probate court, and ensures decision-making autonomy in case of incapacity. A robust estate legacy protects wealth, simplifies matters for loved ones, creates lasting value, and adapts to family dynamics and future needs.

Building a lasting legacy is a profound endeavor, and trust and estate solutions play a pivotal role in ensuring your wishes are realized for generations to come. This article delves into the intricacies of estate legacy planning, offering a comprehensive guide to setting the foundation for a durable legacy. We explore strategic approaches, legal considerations, and future-proofing techniques to help you navigate this complex yet rewarding process. By understanding these key aspects, individuals can make informed decisions, ensuring their estate plans leave a lasting impact.

- Understanding Estate Legacy Planning: Setting the Foundation

- Strategies for Building a Durable Legacy

- Legal Considerations and Tools for Effective Execution

- Ensuring Long-Lasting Impact: Future-Proofing Your Estate Plan

Understanding Estate Legacy Planning: Setting the Foundation

Estate legacy planning involves strategically designing your assets’ distribution and management to ensure your wishes are respected after your passing. It’s a proactive process that allows individuals to leave a lasting impact on their loved ones, shaping their future financial security and upholding their values. By setting clear objectives and taking necessary steps, you can create a solid foundation for the next generation.

This involves assessing your assets, identifying beneficiaries, and selecting suitable trust structures. It’s crucial to consider tax implications, potential legal challenges, and the specific needs of your intended heirs. A well-planned estate legacy not only ensures financial matters are settled efficiently but also fosters peace of mind, knowing your wishes will be carried out as intended, leaving a lasting legacy for future generations.

Strategies for Building a Durable Legacy

Building a durable estate legacy requires thoughtful planning and strategic implementation. One key strategy is creating a comprehensive will, which ensures your assets are distributed according to your wishes after your passing. This document should be regularly reviewed and updated to reflect any changes in your life or financial situation.

Additionally, consider establishing trusts as part of your estate legacy planning. Trusts can provide benefits such as asset protection, tax advantages, and control over when and how beneficiaries receive their inheritance. By employing these strategies, you can safeguard your hard-earned assets, minimize legal complexities for your loved ones, and leave a lasting estate legacy.

Legal Considerations and Tools for Effective Execution

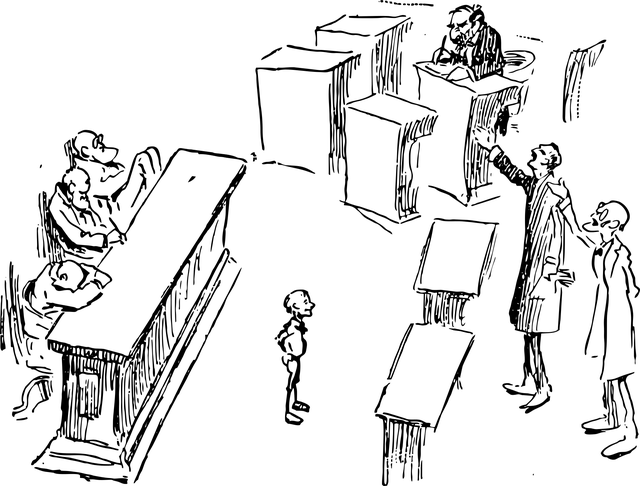

When building an estate legacy, legal considerations are paramount for ensuring your wishes are executed smoothly and effectively. A robust estate legacy plan incorporates various tools and strategies to mitigate potential pitfalls and optimize asset distribution. These include trusts, which offer flexibility in managing and distributing assets while providing privacy and avoiding probate court involvement. Will writing is another critical component, serving as a legal directive that outlines how your property should be divided after your passing.

Additionally, tax-efficient planning is essential for preserving wealth transfer. Professional advisors can guide the use of exemptions, deductions, and special trusts to minimize estate taxes. For complex estates, considering a comprehensive estate plan that integrates living wills, health care directives, and power of attorneys ensures control over decision-making should you become incapacitated. These tools collectively facilitate efficient execution, ensuring your estate legacy is realized according to your specific intentions.

Ensuring Long-Lasting Impact: Future-Proofing Your Estate Plan

Building an enduring estate is about more than just accumulating wealth; it’s about ensuring your legacy lasts for generations to come. Future-proofing your estate plan is a crucial step in achieving this goal, as it allows you to anticipate and mitigate potential challenges that may arise over time. This includes considering the changing legal landscape, tax codes, and financial markets. By staying informed and adaptive, you can create a robust framework that protects your assets and maximizes their impact for future generations.

Estate legacy planning involves strategic thinking about the long-term preservation of your wealth. It requires a comprehensive approach that accounts for shifting family dynamics, evolving needs, and potential unforeseen circumstances. With careful planning, you can ensure your estate serves as a lasting foundation for your descendants, enabling them to pursue their aspirations and maintain financial security well into the future.

Estate legacy planning is not just about wealth transfer; it’s about ensuring your values and vision endure for future generations. By strategically combining legal tools, thoughtful asset allocation, and careful consideration of tax implications, you can build a durable legacy that outlasts time. Remember, the right estate plan acts as a powerful guide, safeguarding your hard-earned assets and guaranteeing your wishes are respected, allowing your heirlooms to be passed down with confidence.